Donor Advised Funds

Charitable Giving Solutions

Maximize the impact your clients can make on their community by growing their giving potential. We offer a variety of strategic philanthropic options that work for you and your clients.

Donor Advised Funds

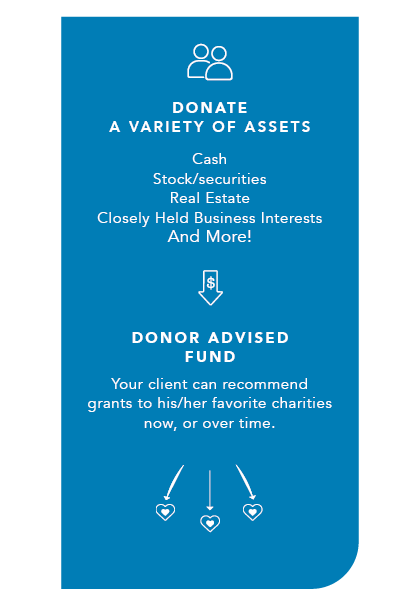

Our most popular giving solution, Donor Advised Funds are a convenient and flexible way for your clients to simplify and maximize the impact of their charitable giving.

Tax Benefits

Donor Advised Funds offer up-front tax benefits while allowing your clients to develop a more strategic giving plan over time.

Give Complex Assets With Ease

Your clients can donate a range of assets to their Donor Advised Fund, which, in many cases, helps to reduce capital gains tax. In addition to cash, your clients can give:

- Cash or check

- Appreciated stock and other securities

- Closely held business interests (S-Corp, C-Corp, LLC)

- Real estate, including farmland

- Grain or other commodities

- Life insurance policies

- Digital currencies

- Other complex, non-cash gifts

Convenience That Matters

Donor Advised Funds eliminate the administrative work of traditional charitable giving, allowing your clients to develop a strategic, long-term philanthropic strategy that lets them experience the true joy of giving. Our online access feature serves as a hub for your clients’ giving, allowing them to recommend distributions from their fund anytime. They can even set up recurring distributions so checks go out to their favorite causes automatically.

Confidentiality/Anonymity

Donor Advised Funds are great options for your clients who wish to remain anonymous in their giving. Distributions can be made in the name of the Community Foundation, protecting the identity and privacy of your clients.

Alternative to a Private Foundation

A Donor Advised Fund might be a great solution if your client is considering setting up a private foundation or ceasing operation of one. It's important to compare the tax advantages to determine the best option for your clients.

Individually Managed Funds

Our Individually Managed Fund program combines the investment expertise your clients rely on with strategic philanthropic planning experience and unmatched community insights offered by the Community Foundation. The Individually Managed Funds program allows external investment advisors to manage the assets of a Donor Advised Fund. Your clients can continue to rely on their preferred investment advisor for trusted expertise while using the Foundation's philanthropic services and community insights.

Investment Portfolios

Your client can choose from the Community Foundation's investment portfolios. Learn more.

Additional Fund Options

Beyond Donor Advised Funds, we offer a variety of additional fund options to meet your client's charitable giving needs:

The ultimate expression of values and passions, a deferred legacy fund allows your clients to fund this endowment after their life in order to continue supporting the nonprofits and causes they care about, even after they're gone.

These endowments are created by donors who want to support a general area of philanthropic work. Whether your client's interests lie in youth enrichment, the art, or outdoor recreation, the Community Foundation will work with your client to design a grant selection process that achieves their vision.

Our Individually Managed Fund program combines the investment expertise your clients rely on with strategic philanthropic planning experience and unmatched community insights offered by the Community Foundation.

The Individually Managed Funds program allows external investment advisors to manage the assets of a Donor Advised Fund. In short, we provide excellent philanthropic services while a donor’s preferred financial advisor manages the assets.

Download a PDF about our program and policies here.

How it works

- We establish an investment account at your firm for your client’s charitable fund, and you provide the investment services. The assets in your client’s charitable fund remain under your management.

- Your clients have access to our team of experts to assist in their strategic giving.

- Your clients recommend grants from their fund to support the causes and nonprofits they care about.

- Your clients have online access to view detailed fund activity and information about their fund anytime.

- Investment performance information is provided to your client through your organization.

Opening balance and fees

A minimum opening balance of $150,000 is required for an Individually Managed Fund.

We charge regular administrative fees on each account based on the balance of the account. Our current fee structure is:

- 1.00% on the first $1M

- 0.50% on the next $4M

- 0.25% on the next $5M

- 0.125% on balances above $10M

We'll work with you to arrange the fee for the investment management of your client's Individually Managed Fund.

Investments

Your client can choose from the Foundation's three investment portfolios.

If your client wishes to support one or more organizations, an organizational endowment might be a good fit. These funds pay annual distributions to the organizations of choice and can be established with current or deferred gifts.

Tax Advantages

Your client will benefit from the Foundation's 501(c)(3) status to receive maximum tax advantages.

Gifts of cash to the Community Foundation are deductible up to 60% of the donor’s adjusted gross income (with a five-year carry forward), while gifts of cash to a private foundation are deductible only up to 30% of the donor’s adjusted gross income (with a five-year carry forward).

Gifts of publicly traded securities are generally deductible at 100% of the fair market value, including the avoidance of capital gain, at up to 30% of the donor’s adjusted gross income (with a five-year carry forward). Gifts of publicly traded securities to a private foundation, on the other hand, are only deductible up to 20% of the donor’s adjusted gross income (with a five-year carry forward).

The market value of a gift of publicly traded securities is calculated as the average of the high and low selling prices on the date the gift is received in a Community Foundation account. Once received, we will sell the shares at the earliest practical date. The amount deposited to the donor’s fund of choice will be the value of the shares when we sell the stock, less any sales or administrative fees or commissions.

Transferring shares to the Community Foundation is efficient and easy. Call us at 605.336.7055 to get started on a transfer.

Gifts of private assets (e.g., real estate, private company stock) are deductible at their fair market value up to 30% of the donor’s adjusted gross income (with a five-year carry forward), while gifts of private assets to a private foundation are limited to their cost basis up to 20% of the donor’s adjusted gross income (with a five-year carry forward).

Gifts received through a donor’s estate are generally 100% deductible for estate tax purposes, with no limitation.

Gifts of tangible personal property, such as art, antiques and collectibles, may be donated to the Community Foundation. The gift will be evaluated by the Foundation before acceptance. The donor is responsible for securing an independent appraisal of the item(s) if the value of the gift is over $5,000.

PLEASE NOTE, WHILE WE OFFER GUIDANCE AND CAN HELP TALK THROUGH GIVING SOLUTIONS WITH YOU AND YOUR CLIENT, WE ARE NOT PROFESSIONAL TAX ADVISORS, FINANCIAL ADVISORS OR ATTORNEYS.