News for Donors

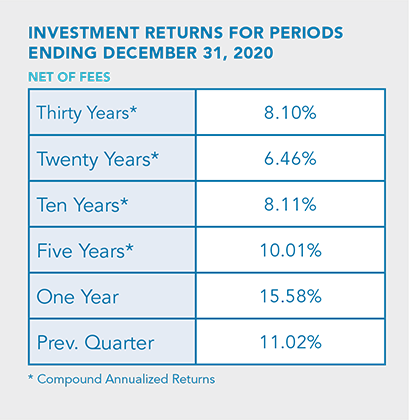

Investment Update: Winter 2021

The equity market decline that began in latter part of the third quarter carried through the beginning of the fourth quarter. Markets shifted and positive returns carried through the months of November and December. This was evident in the S&P 500, which had a monthly return of -2.66% for October, but shifted and finished 2020 with monthly returns of 10.95% and 3.84% for November and December, respectively.

The investment model utilized by the Sioux Falls Area Community Foundation indicates that domestic equity valuations remain high.

With valuations high, the Foundation continues to maintain its minimum equity allocation of 65%.

This allocation favors value over growth by a weighting of 70/30 and international over domestic by 56/44. A tactical target for cash of 16% gives flexibility for periods of volatility and uncertainty.

The Investment Committee continues to review and rely on guidance from the SD Investment Council and maintains a disciplined approach to investing the Foundation’s assets.